AHM-520 Exam

All About Virtual AHM-520 Exam Topics

Want to know Testking AHM-520 Exam practice test features? Want to lear more about AHIP Health Plan Finance and Risk Management certification experience? Study Pinpoint AHIP AHM-520 answers to Refresh AHM-520 questions at Testking. Gat a success with an absolute guarantee to pass AHIP AHM-520 (Health Plan Finance and Risk Management) test on your first attempt.

AHIP AHM-520 Free Dumps Questions Online, Read and Test Now.

NEW QUESTION 1

Health plans have access to a variety of funding sources depending on whether they are operated as for-profit or not-for-profit organizations. The Verde Health Plan is a for-profit health plan and the Noir Health Plan is a not-for-profit health plan. From the answer choices below, select the response that correctly identifies whether funds from debt markets and equity markets are available to Verde and Noir:

- A. Funds from Debt Markets: available to Verde and Noir Funds from Equity Markets: available to Verde and Noir

- B. Funds from Debt Markets: available to Verde and Noir Funds from Equity Markets: available to Verde only

- C. Funds from Debt Markets: available to Verde only Funds from Equity Markets: available to Noir only

- D. Funds from Debt Markets: available to Noir only Funds from Equity Markets: available to Verde only

Answer: B

NEW QUESTION 2

The amount of risk for health plan products is dependent on the degree of influence and the relationships that the health plan maintains with its providers. Consider the following types of managed care structures:

✑ Preferred provider organization (PPO)

✑ Group model HMO

✑ Staff model health maintenance organization (HMO)

✑ Traditional health insurance

Of these health plan products, the one that would most likely expose a health plan to the highest risk is the:

- A. preferred provider organization (PPO)

- B. group model HMO

- C. staff model health maintenance organization (HMO)

- D. traditional health insurance

Answer: C

NEW QUESTION 3

The following statements are about the new methodology authorized under the Balanced Budget Act of 1997 (BBA) for payments by the Centers for Medicaid & Medicare Services (CMS) to Medicare-contracting health plans.

Select the answer choice containing the correct statement.

- A. Under this new methodology, Medicare-contracting health plans are paid the lower of (a) a floor payment amount per enrollee covered or (b) the health plan's payment rate increased by 2% from the previous year.

- B. The new methodology has decreased the rate of growth in payments from CMS to Medicare-contracting health plans.

- C. Under this new methodology, Medicare-contracting health plans are paid 90% of the adjusted average per capita cost (AAPCC) of providing a service to a beneficiary.

- D. Under the principal inpatient diagnostic cost group (PIP-DCG), a new risk adjustment methodology, Medicare-contracting health plans will no longer be required to calculate and submit to CMS a Medicare adjusted community rate (ACR).

Answer: B

NEW QUESTION 4

A health plan can use cost accounting in order to

- A. Determine premium rates for its products

- B. Match the costs incurred during a given accounting period to the income earned in, or attributed to, that same period

- C. Both A and B

- D. A only

- E. B only

- F. Neither A nor B

Answer: A

NEW QUESTION 5

Doctors’ Care is an individual practice association (IPA) under contract to the Jasper Health Plan to provide primary and secondary care to Jasper’s members. Jasper’s capitation payments compensate Doctors’ Care for all physician services and associated diagnostic tests and laboratory work. The physicians at Doctors’ Care, as a group, determine how individual physicians in the group will be remunerated. The type of capitation used by Jasper to compensate Doctors’ Care is known as:

- A. PCP capitation

- B. Partial capitation

- C. Full professional capitation

- D. Specialty capitation

Answer: C

NEW QUESTION 6

The following statement(s) can correctly be made about a health plan's cash receipts and cash disbursements budgets:

- A. To predict both the timing and the amount of its cash receipts, a health plan constructs the cash receipts budget using data from its sales forecast and investment forecasts.

- B. A health plan uses a cash disbursements budget in order to establish the amount, but not the timing, of all of its cash disbursements.

- C. Both A and B

- D. A only

- E. B only

- F. Neither A nor B

Answer: B

NEW QUESTION 7

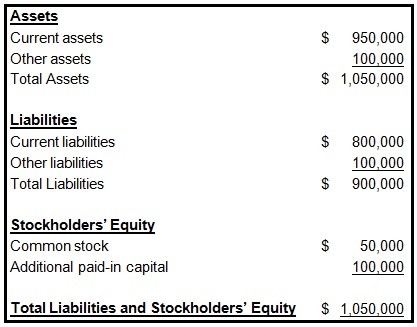

The following information was presented on one of the financial statements prepared by the Rouge health plan as of December 31, 1998:

When calculating its cash-to-claims payable ratio, Rouge would correctly divide its:

- A. Cash by its reported claims only

- B. Cash by its reported claims and its incurred but not reported claims (IBNR)

- C. Reported claims by its cash

- D. Reported claims and its incurred but not reported claims (IBNR) by its cash

Answer: B

NEW QUESTION 8

Rasheed Azari, the risk manager for the Tower health plan, is attempting to work with providers in the organization in order to reduce the providers' exposure related to utilization review. Mr. Azari is considering advising the providers to take the following actions:

✑ 1-Allow Tower's utilization management decisions to override a physician's independent medical judgment

✑ 2-Support the development of a system that can quickly render a second opinion

in case of disagreement surrounding clinical judgment

✑ 3-Inform a patient of any issues that are being disputed relative to a physician's recommended treatment plan and Tower's coverage decision

Of these possible actions, the ones that are likely to reduce physicians' exposures related to utilization review include actions

- A. 1, 2, and 3

- B. 1 and 2 only

- C. 1 and 3 only

- D. 2 and 3 only

Answer: D

NEW QUESTION 9

With regard to a health plan's underwriting of groups, it can correctly be stated that, generally, a

- A. Health plan will require that contributory healthcare plans have a participation level of between 50% and 70%

- B. Health plan will decline to cover a group that has been formed for the sole purpose of obtaining healthcare coverage

- C. Health plan's underwriters will not examine the age spread of the entire group being underwritten

- D. Health plan would expect a group with a large proportion of young females to have lower healthcare costs than does a similar group with a large proportion of young males

Answer: B

NEW QUESTION 10

The Sesame health plan uses a method of accumulating cost data that enables the health plan to satisfy financial reporting requirements for compiling financial statements and corporate tax returns. Although this method assists Sesame's managers in studying which types of costs are rising and falling over time, it does not explain which areas of Sesame incur each cost. This method, which is the most basic level of cost accumulation, is known as accumulating costs by

- A. Cost center

- B. Type of cost

- C. Lines of business

- D. Function

Answer: B

NEW QUESTION 11

The medical loss ratio (MLR) for the Peacock health plan is 80%. Peacock's expense ratio is 16%.

Peacock's MLR and its expense ratio indicate that Peacock

- A. Has a 4% potential profit margin

- B. Has a combined ratio of 64%

- C. Must increase its premium income in order to remain in business

- D. Must rely on investment income in order to avoid financial losses

Answer: A

NEW QUESTION 12

The following statements illustrate common forms of capitation:

* 1. The Antler Health Plan pays the Epsilon Group, an integrated delivery system (IDS), a capitated amount to provide substantially all of the inpatient and outpatient services that Antler offers. Under this arrangement, Epsilon accepts much of the risk that utilization rates will behigher than expected. Antler retains responsibility for the plan's marketing, enrollment, premium billing, actuarial, underwriting, and member services functions.

* 2. The Bengal Health Plan pays an independent physician association (IPA) a capitated amount to provide both primary and specialty care to Bengal's plan members. The payments cover all physician services and associated diagnostic tests and laboratory work.

The physicians in the IPA determine as a group how the individual physicians will be paid for their services.

From the following answer choices, select the response that best indicates the form of capitation used by Antler and Bengal.

- A. Antler = subcapitation Bengal = full-risk capitation

- B. Antler = subcapitationBengal = full professional capitation

- C. Antler = global capitation Bengal = subcapitation

- D. Antler = global capitationBengal = full professional capitation

Answer: D

NEW QUESTION 13

The Newfeld Hospital has contracted with the Azalea Health Plan to provide inpatient services to Azalea's enrolled members. The contract calls for Azalea to provide specific stop-loss coverage to Newfeld once Newfeld's treatment costs reach $20,000 per case and for Newfeld to pay 20% of the next $50,000 of expenses for this case. After Newfeld's treatment costs on a case reach $70,000, Azalea reimburses the hospital for all subsequent treatment costs.

One true statement about this specific stop-loss coverage is that

- A. The carrier is Newfeld

- B. The attachment point is $20,000

- C. The shared-risk corridor is between $0 and $70,000

- D. This coverage can also be activated when the total covered medical expensesgenerated by the hospitalizations of Azalea plan members reach a specified level

Answer: B

NEW QUESTION 14

Health plans with risk-based Medicare contracts are required to calculate and submit to CMS a Medicare adjusted community rate (Medicare ACR). Medicare ACR can be defined as the:

- A. Estimated cost of providing services to a beneficiary under Medicare FFS, adjusted for factors such as age and gender

- B. Health plan’s estimate of the premium it would charge Medicare enrollees in the absence of Medicare payments to the health plan

- C. Average amount the health plan expects to receive from CMS per beneficiary covered

- D. Health plan’s actual costs of providing benefits to Medicare enrollees in a given year

Answer: B

NEW QUESTION 15

The Health Maintenance Organization (HMO) Model Act, developed by the National Association of Insurance Commissioners (NAIC), represents one approach to developing solvency standards. One drawback to this type of solvency regulation is that it

- A. Uses estimates of future expenditures and premium income to estimate future risk

- B. Fails to adjust the solvency requirement to account for the size of an HMO's premiums and expenditures

- C. Assumes that the amount of premiums an HMO charges always directly corresponds to the level of the risk that the HMO faces

- D. Fails to mandate a minimum level of capital and surplus that an HMO must maintain

Answer: C

NEW QUESTION 16

The following statements are about a health plan's capital budgeting process. Select the answer choice containing the correct statement.

- A. Under sensitivity analysis, a health plan ranks all capital project proposals according to expected rates of return and accepts only those proposals with the highest rankings.

- B. A project that has a profitability index of 0.0 has an NPV of zero.

- C. An underlying assumption of capital budgeting is that a health plan should keep its investing decisions separate from its financing decisions.

- D. Under the internal rate of return (IRR) method, if a project's IRR is less than a health plan's weighted average cost of capital (WACC), then the project's benefits should exceed its costs and the health plan should accept the project.

Answer: C

NEW QUESTION 17

......

Recommend!! Get the Full AHM-520 dumps in VCE and PDF From DumpSolutions.com, Welcome to Download: https://www.dumpsolutions.com/AHM-520-dumps/ (New 215 Q&As Version)